Why Coinsurance matters:

1. It Determines the Minimum Required Coverage

The coinsurance clause specifies a percentage, 80%, 90%, or 100% of your property’s total replacement value that you must insure.

- Example: If your building has a replacement value of $1,000,000 and your policy has an 80% coinsurance clause, you are required to have at least $800,000 of insurance coverage to satisfy the coinsurance clause.

2. It Prevents Underinsurance and Ensures Fair Premiums

Most property losses are partial, not total. Without a coinsurance clause, a property owner might insure a $500,000 building for only $100,000 to save money on insurance premiums, figuring that most claims are small.

- For the Insurer: The coinsurance clause ensures the insurer is collecting a premium based on a reasonable amount of the total value of the risk.

- For the Policyholder: It prevents you from being severely underinsured in the event of a catastrophic loss and provides a more equitable way to calculate premiums across all policyholders.

3. The Coinsurance Penalty Significantly Reduces Claim Payouts

This is the most critical reason why it matters. If you suffer a loss and the adjuster determines you did not meet the required coinsurance percentage, the insurer will apply a coinsurance penalty to your claim payout. You become a “co-insurer” on the loss, meaning you pay a portion out of pocket.

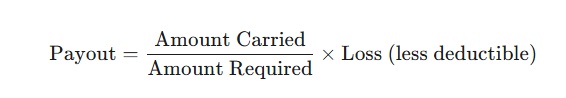

The penalty is calculated using the following formula (or a variation of it):

💡 Penalty Example

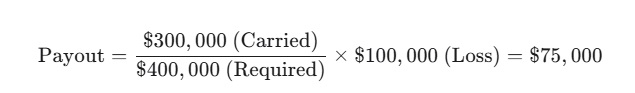

Let’s use the $500,000 building with an 80% coinsurance requirement, meaning you need to carry a minimum of $400,000 in coverage.

- Scenario: You only insured the building for $300,000

- Loss: A fire causes $100,000 in damage. (Assume a $1,000 deductible).

The penalty calculation would be:

You would receive $75,000$ minus your $1,000$ deductible, so $74,000. Even though your insurance limit was $300,000 (far more than the loss), you are penalized for not meeting the 80% requirement. You would have to pay the remaining $100,000 – $74,000 = $26,000 out of pocket.

If you had met the requirement and insured for at least 400,000, your payout would have been the full $100,000 loss minus the deductible, or $99,000.

How do you avoid the Coinsurance Pitfall?

- Insure to Full Replacement Value: Always aim to insure your property for 100% of its estimated replacement cost, even if your coinsurance clause is 80% or 90%. This gives you a buffer against potential changes in construction costs.

- Regularly Review Policy Limits: Replacement costs for labor and materials can increase over time, so review your coverage with your agent annually to ensure your limit keeps pace with inflation and rising construction costs.

- Consider an Agreed Value Endorsement. Some insurers allow you to add an “Agreed Value” endorsement, where you and the insurer agree on the property’s value upfront, and the coinsurance clause is waived for the policy term

What coinsurance should you have?

Some agents may recommend one coinsurance over another but as with many insurance items, it’s not that simple.

Why do some recommend 80% coinsurance?

1. Less Required Coverage

The coinsurance percentage defines the minimum amount of coverage you must carry to avoid a penalty. A lower percentage means a lower required coverage amount.

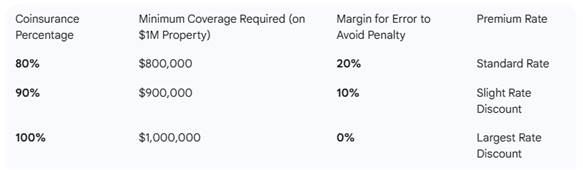

- Example: Assume your building’s current replacement cost value is $1,000,000.

- 80% Coinsurance: You must carry a minimum of $800,000 in coverage ($1,000,000 X 0.80).

- 90% Coinsurance: You must carry a minimum of $900,000 in coverage ($1,000,000 X 0.90).

You have a $100,000 greater margin of error (the difference between $800,000 and $900,000) with the 80% clause.

2. The “Cushion” Against Underinsurance

Property values, especially replacement costs, can change rapidly due to inflation, material costs, and labor shortages. The value calculated at the start of your policy might be lower than the true replacement cost determined by an adjuster after a loss occurs.

The 80% clause gives you a 20% cushion of potential undervaluation before you face a penalty.

- If your coverage is $800,000 (exactly 80%) but the adjuster determines the current replacement value is actually $1,005,000 at the time of loss, with an 80% clause, you are slightly underinsured and may face a penalty.

- With a 90% clause, your required coverage would be $904,500 ($1,005,000 X 0.90). It’s much easier to fall below that higher required limit, triggering a penalty on your claim.

3. Rate/Premium Considerations (The Trade-off)

The main reason an insurance company offers a higher coinsurance percentage (like 90% or 100%) is to incentivize you to buy a higher limit of coverage.

- Higher Coinsurance (90% or 100%): You will likely receive a discount on your premium rate because the insurer has more of the property’s value covered.

- Lower Coinsurance (80%): The rate is typically the insurer’s standard or base rate, but you get the benefit of a lower penalty risk.

Eliminating the Coinsurance Penalty Risk Entirely

If both the insured and the insurance company agree that the insured amount is the true replacement cost of the property upfront and insure it at 100%, adding an Agreed Value Endorsement waives the coinsurance clause entirely. This is often the true best option for commercial properties.

Why This Is the “Best” Option for Coinsurance

The biggest benefit of the Agreed Value Endorsement is certainty.

- Eliminates the “Guessing Game”: With standard coinsurance, you must correctly guess the property’s replacement cost value 12 months in advance, and you must guess what an adjuster will determine it to be after a loss. Agreed Value fixes the number upfront, removing all doubt.

- No Penalty from Inflation: If construction costs unexpectedly jump 15% during the policy year (making your building now worth $1,150,000), a regular 80% coinsurance policy would penalize you. With Agreed Value, the insurer still honors the original agreed-upon value of $1,000,000, and no penalty applies.

- Simplified Claims: The claims process is often faster because the insurer doesn’t need to spend time having an appraiser determine the property’s replacement cost at the time of loss to check for a penalty.

Key Condition and Caveat

- You Must Insure to the Agreed Value: If the agreed value is $1,000,000, and you only buy a $950,000 limit to save on premium, the Agreed Value Endorsement is voided, and you fall back to the standard coinsurance clause (e.g., 80% or 90%) and its associated penalty risk.

- Annual Renewal: The agreement typically lasts for the policy term (usually one year). You must submit an updated Statement of Values (SOV) annually to renew the endorsement and ensure your limit still reflects the current replacement cost.

In short, the Agreed Value Endorsement provides the peace of mind that you will receive the full amount of your partial loss (up to your policy limit) without the stressful possibility of a coinsurance penalty deduction.