Insurance language can sound confusing, but it doesn’t have to be. At its heart, it’s just about making sure you can replace the things you need for your business, whether they’re stuck in the office or always on the go.

🏢 Business Personal Property (BPP) Insurance

BPP is the foundation of property coverage for most businesses.

Coverage and Advantages:

- Coverage for Fixed Assets: It covers tangible property used for your business that is kept at your primary location.

- Examples: Office desks, filing cabinets, stationary manufacturing machinery, retail inventory on shelves, computers at the office.

- Protection Against Common Perils: It provides financial protection if those assets are damaged or destroyed by covered perils (like fire, windstorm, or theft) at the insured location.

- Part of a Package: It is often bundled with general liability and business income coverage in a Business Owner’s Policy (BOP), providing comprehensive basic protection at a reduced cost.

- Coverage is typically provided on a Replacement Cost (RC) Basis.

Limitation (Why you need Inland Marine):

- Coverage often has strict geographic limits and may not cover property once it’s taken more than a certain distance (e.g., 1,000 feet) from your insured location.

- It is generally not designed to cover tools and equipment that are constantly moving between job sites or in transit.

🚚 Inland Marine Insurance

Despite the name, it’s about land-based movement. It essentially fills the coverage gap left by standard BPP policies.

Coverage and Advantages:

- Covers Property in Transit: It protects your goods, materials, or equipment while they are being transported via land (truck, train, etc.).

- Advantage: This is crucial for businesses that ship products or move equipment between locations.

- Covers Property Off-Site: It protects your assets when they are temporarily stored at a job site, a third-party warehouse, or in an employee’s vehicle.

- Advantage: Essential for contractors, photographers, landscapers, vendors, and mobile equipment operators whose gear is rarely at their main office.

- Covers Specialized/High-Value Items: It can be used to insure valuable, movable assets that may be under-covered or excluded by a standard BPP policy, such as fine art, communication equipment, or specialized medical devices.

- Coverage is typically provided on an Actual Cash Value (ACV) basis

Limitation:

- It does not cover your fixed assets or building at your main business location—that’s the job of your standard Commercial Property/BPP policy.

🎯 Which One Do You Need?

You likely need both if your business:

- Has a fixed location with furnishings, equipment, or inventory (needs BPP).

- Regularly moves valuable tools, equipment, or inventory off-site, to job sites, or ships products to customers (needs Inland Marine).

For example, a general contractor needs BPP for the office equipment at their headquarters, and Inland Marine for the bulldozer, power tools, and building materials at a construction site or being hauled on a flatbed trailer.

What if you have a choice?

Insurance is based on a variety of factors and everyone’s situation may be different, but from our perspective Business Personal Property is typically less expensive and offers a coverage advantage as items are insured at Replacement Cost (no depreciation).

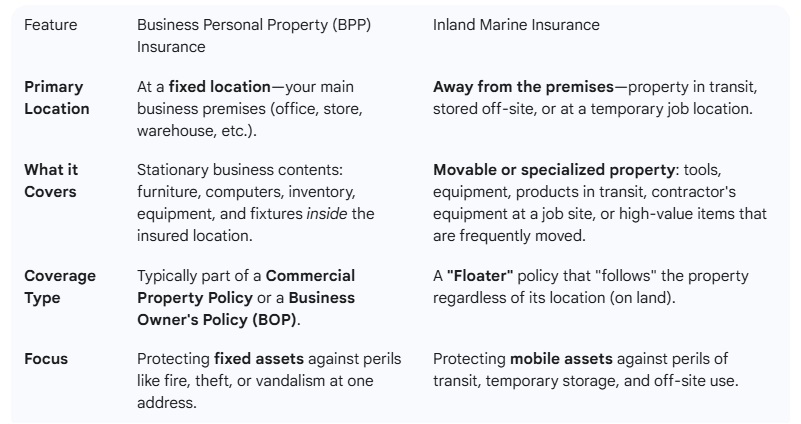

🔑 Key Differences: Location and Scope